If you have been delaying socking some money away for the future, you’re one of millions of people. It’s easy to procrastinate when it comes to saving money. There’s always that new gadget to buy, that grand vacation to take. But these items may come at a higher price than you realize. Consider this: If you were to begin saving just $2,000 a year—about $167 a month—in an Individual Retirement Account (IRA) at age 22, and you earned an average annual rate of 10% on your money over the years, you would be a millionaire before the age of 65. If you wait until you’re 30 years old to begin saving this amount, you will have less than $550,000 in your account at age 65.

You might think that a return of 10% a year is an outrageously unrealistic expectation, given the abysmal interest rates that banks are paying on savings account deposits these days, However, history says otherwise. The average annual return on the S&P 500 Index, a portfolio of stocks of 500 of the largest U.S. companies, from January 1, 1871 through December 31, 2011 is around 10%. That takes into account a lot of economic booms and busts. If we use data from only the past thirty years—from 1981 through 2011—the average is even higher around 12%. So, it’s possible that you might earn an average return of more than 10% on your money over the years. And even if you were to earn a lower rate, it’s still advantageous to start saving sooner rather than later.

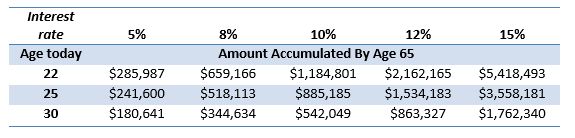

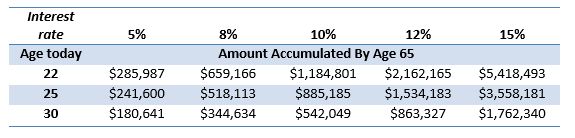

The table below displays the amount that you can accumulate by age 65 if you begin saving $2,000 a year at varying ages and earn 5%, 8%, 10%, 12%, or 15% a year on your money.

Notice that regardless of the average annual interest rate earned, waiting the extra eight years from 22 to 30 years old results in a significantly lower account balance at age 65. This is because of the compounding effect. When you invest your money, earn interest on it, and leave the interest in the account, you earn interest on your interest the next year. And so on it grows.

Imagine what you could accumulate for retirement if you were to save more than $2,000 a year. The maximum allowed IRA contribution for most people in 2012 is $5,000, but you can save even more than this in a tax-deferred account by taking full advantage of your employer’s 401k plan (or 403b plan for public school employees and employees of certain tax-exempt organizations). Many employers will match your contribution to these types of plans, so that part is “free” money that won’t crimp your budget.

Start early; finish early. You can retire at a young age and move on to engage in activities that you find appealing. Maybe you envision yourself sailing into the sunset—quite literally, on your new 40-foot sailboat.

But saving for retirement shouldn’t be your only savings goal. The compound interest effect works if you’re socking away money for a new car, wedding, house, vacation, or the kids’ college tuition, too. If you plan today for the major outlays you’re expecting to incur in the future, you will in a position to pay cash for a lot of these things and avoid debt entirely. Imagine returning from a great relaxing vacation without being faced with a stack of credit card bills that will take you months, if not years, to pay in full upon your return—again because of the compounding effect, but in this case it is your lenders who will be enjoying the benefits. Debt is a burden you don’t need—and don’t have to have—in your life. Instead of paying interest to others, earn interest for yourself.

You may have, at some point, looked at others who have accumulated some wealth with envy, wishing you could enjoy some of the things that their money buys them. If you start saving today, you can join their ranks and become the envy of your peers, too. And even better, you will be creating a sound financial life for yourself, which translates to a life that will be significantly less stressful—one that you will be able to enjoy to the fullest, doing the things that you want to do.